What do luxury brands tend to do in an economic downturn? Answer: they focus on their top spenders.

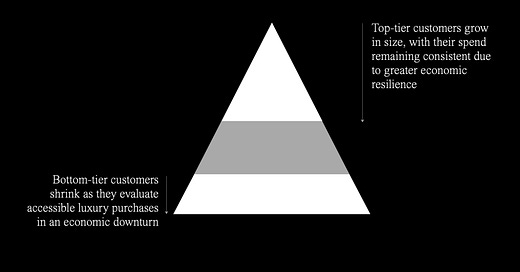

With a recession knocking loudly on our door (and perhaps already here), luxury brands are shifting their focus away from bottom-tier customers impacted by the downturn and towards top-tier customers who are more resilient:

Growing top, shrinking bottom

Bottom-tier customers – those dipping their toe in luxury for the first time or who purchase entry-level luxury products only occasionally – are understandably re-evaluating the need for luxury during a period of rising costs of living and when their disposable income is being squeezed. And there is growing evidence that this is now placing pressure on entry-level luxury goods.

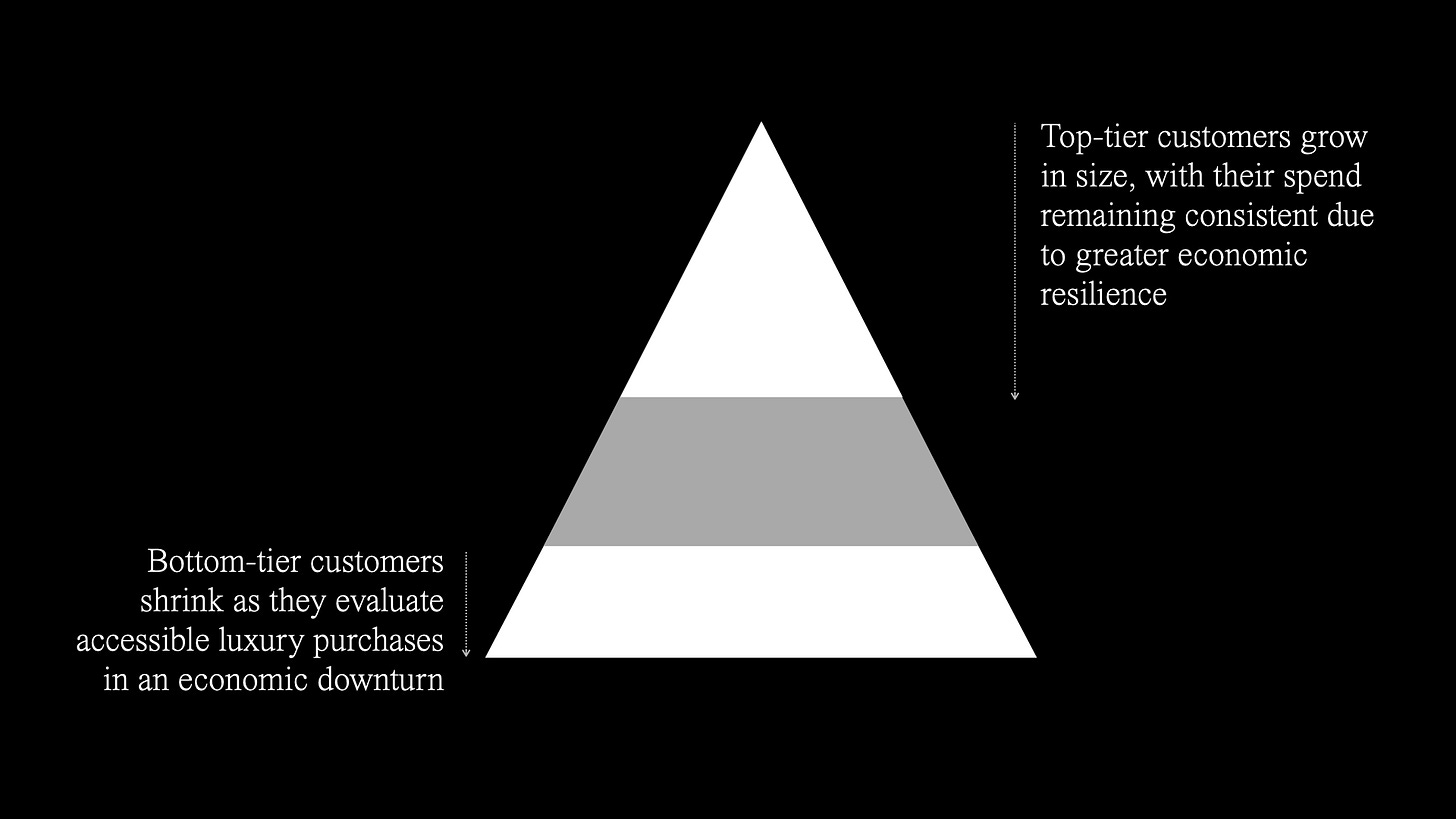

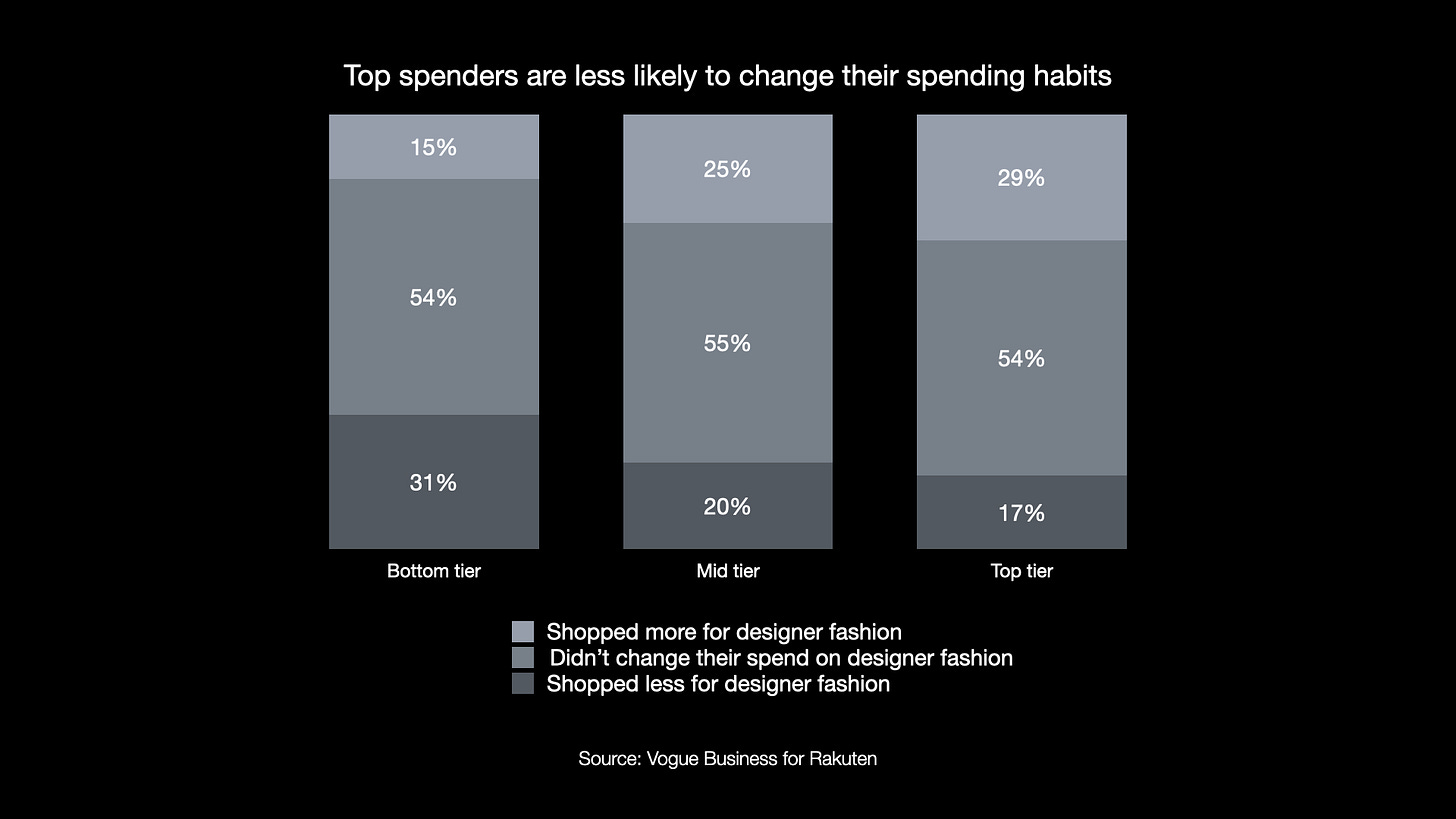

At the same time, it appears that top spenders are showing signs of sustained spend in the face of inflation, thereby becoming a greater proportion of the overall luxury market, as this recent set of data from Vogue Business and Rakuten shows:

As a result – according to the latest ‘Worldwide Luxury Market Monitor’ report by Bain & Altagamma – luxury brands are now putting VIC strategies “into overdrive”.

Chanel’s CFO has concurred with this strategy, commenting in Business of Fashion that, "our biggest preoccupation is to protect our customers and in particular our pre-existing customers. We’re going to invest in very protected boutiques to service clients in a very exclusive way.”

The top-tier playbook

A new top-tier customer playbook is now emerging, turning the brand experience into something that mixes together a concierge service, members club, and top-end hospitality brand.

We can divide this playbook into two parts: ‘One-of-few’ experiences that cultivate community and reinforce the sense of belonging among elite customers. And ‘One-to-one’ experiences, where the priority is service, care, and attention - all executed in a convenient and focused way:

One-of-few: Product editions

These are limited edition products that are – importantly – only available to purchase on an invite-only basis, thus creating a true barrier that goes beyond the ‘drop’ model or restricted production. They should be considered collectible editions, making it clear that, by owning one of them, the customer has effectively gained membership to an elite group. They can also be merchandise items that are only given to top, loyal customers – the ‘Amanjunkie’ baseball cap is perhaps the perfect archetype of this.

One-of-few: Inside access

Many luxury brands are taking lessons from luxury hospitality to create one-of-a-kind experiences and offer exclusive access to industry events – with the objective to ‘treat’ these customers and gain their loyalty. Flying out to charity galas, luxury trips to music festivals, and a runway show at a Capri resort are just some of the all-expenses ways Givenchy, Gucci and Pucci respectively have been privately entertaining their VICs. The key is for the brand to make their VIC guest feel like an industry insider – a dinner where they rub shoulders with the creative director, for instance – an access point that only that particular brand can offer, and that would otherwise be completely off limits to a regular customer.

One-to-one: Customised service

These build on the one-to-one digital relationships that luxury brands forged with customers during the pandemic – a period when these customers were stuck at home, and so store assistants turned to messaging and video streaming in order to help them to shop. Through this kind of online ‘clienting’, brands keep customers in-the-know about forthcoming products, making personal recommendations, and providing immediate responses to styling and product queries. It’s vital these are done in a human way, with dedicated brand assistants who slowly build an understanding of the client’s aesthetic tastes and communication preferences – an experience a million miles away from talking to lifeless bots on e-commerce sites.

One-to-one: Private space

Finally, having dedicated space for private interaction is key, and many retail spaces are carving out separate, invite-only areas – or entire stores – where personalised service can be carried out with focus and care, and away from the masses found on the flagship’s busy shop floor. Examples include: Brunello Cucinelli’s private boutique in New York; Chanel’s forthcoming ‘private’ retail spaces; and the 30 Avenue Montaigne Dior flagship in Paris, where a whole apartment suite is available for top clients, complete with butler service and 24-hour access to anything and everything the store offers.