The clue is in the name: Louis Vuitton, Moët, Hennessy.

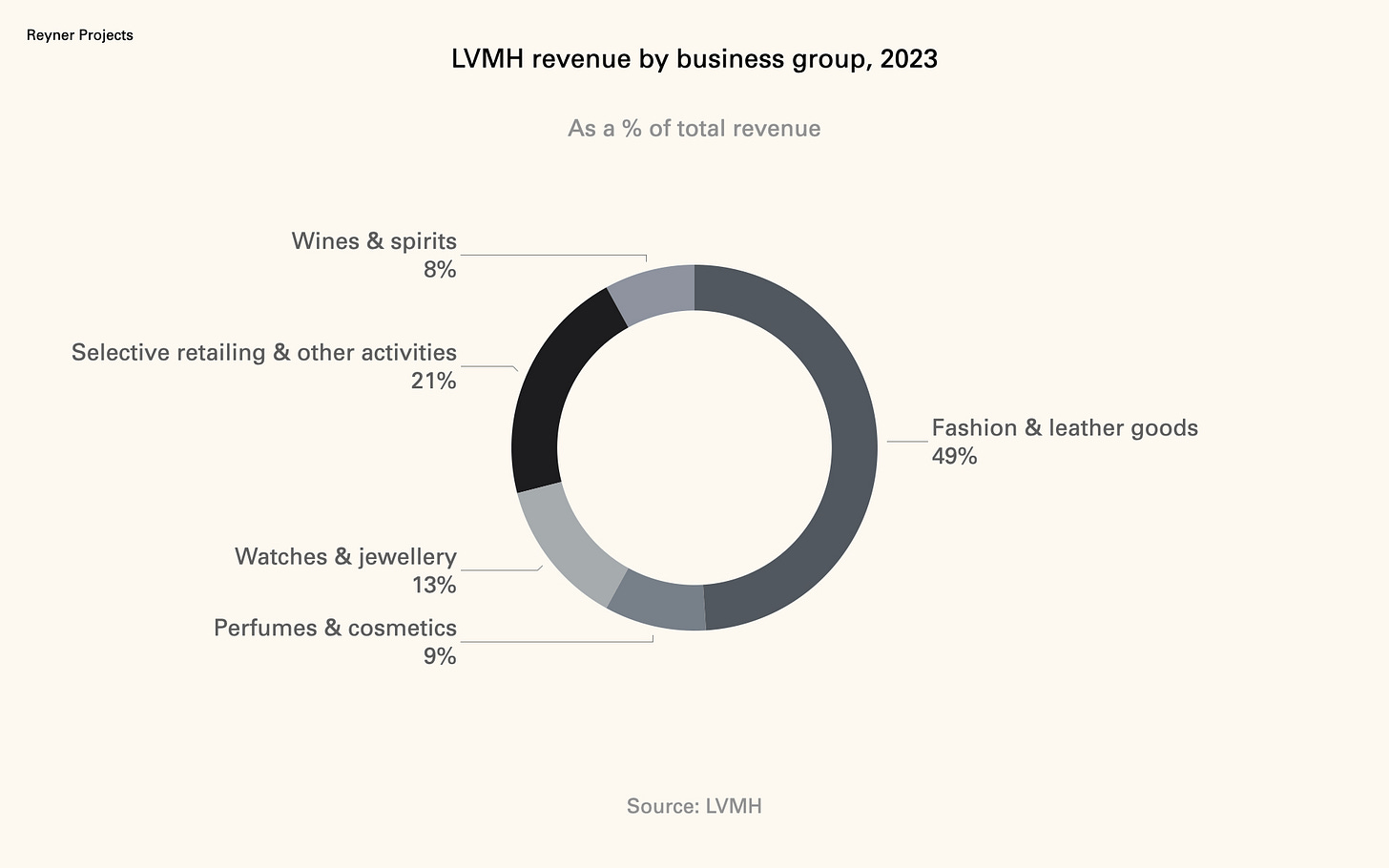

Three powerhouse brands that span not one, but two luxury sectors: fashion and leather goods, wines and spirits. And that's just the beginning of the luxury giant’s diverse portfolio, which also includes perfumes and cosmetics, watches and jewellery, and (the rather catch-all) ‘selective retailing and other activities’.

Over the years, shrewd acquisitions have broadened LVMH’s repertoire of world-class brands, expanding across multiple sectors. It now boasts greater diversification than rivals Kering (focused heavily on luxury fashion, with some eyewear and jewellery) and Richemont (which encompasses watchmaking, jewellery, fashion, and digital retail activities).

LVMH leans towards apparel, with fashion and leather goods contributing around half (49%) of revenues, according to the group’s latest reports. However, its broad division categorisation somewhat obscures the group’s true diversity, with distinct activities including publishing, airport retail, and ownership of two of the most reputable hotel brands (Belmond and Cheval Blanc).

While de-risking is a clear part of this portfolio strategy, aimed at maintaining shareholder value during market fluctuations, there's another crucial dynamic at play: the enhancement, even ‘ownership’, of the luxury customer journey.

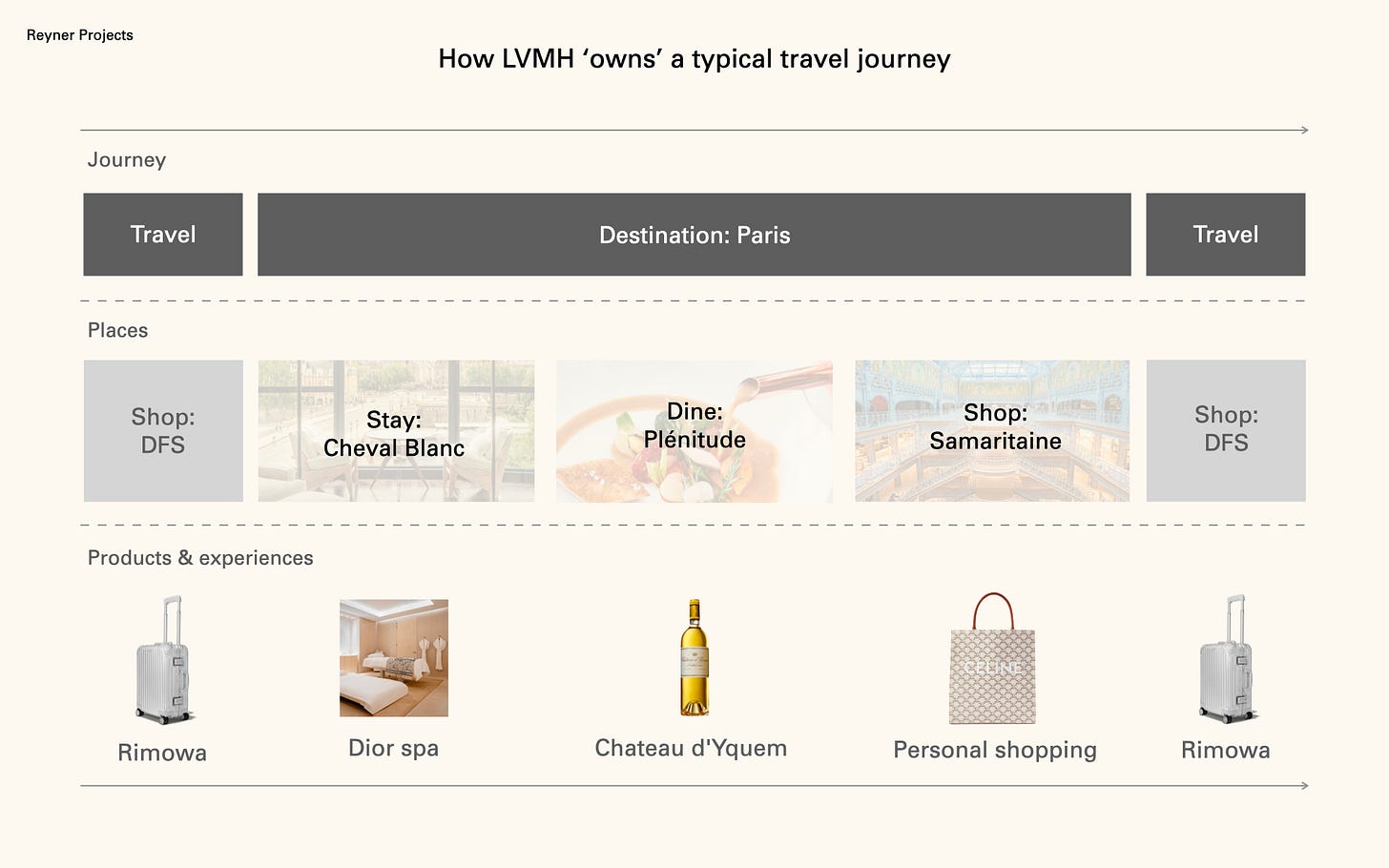

Owning the affluent journey

Picture, for a moment, an affluent family from China embarking on a European adventure of fine dining and high-end shopping – a consumer group that accounted for around a third of global luxury sales pre-pandemic.

They arrive at their destination, Cheval Paris, with half a dozen Rimowa cases in tow. During their stay, they receive personalised shopping experiences at the adjacent Samaritaine department store. Dinner is at the three-starred Plénitude; a bottle of Château d’Yquem is ordered with dessert. The next day, they embark on an excursion to witness the inner workings of the Celine atelier. En route home, they stock up on duty-free goods from a retailer operated by DFS.

All of the above retailers and brands are owned by LVMH – the breadth and depth of the portfolio being extensive enough to effectively cater to an entire trip and without the consumer even realising it.

A big part of what makes this possible is owning a hotel brand with a property within a key luxury destination, which provides a vital base for the customer journey. During the guest’s stay, LVMH’s diverse array of brands can target the guests, both on-property and across the city.

It’s worth noting that Cheval Blanc has also considered opening new properties adjacent to London’s Bond Street and Los Angeles’ Rodeo Drive. Though these plans appear to have been delayed or shelved, it shouldn’t be a coincidence that these locations, like that of Paris, are near high-end shopping hotspots full of LVMH-owned brands.

Creating moments from inspired integration

LVMH is also in the business of cleverly pairing one brand with another, integrating them seamlessly into the customer experience.

At one of its Belmond properties in Sicily, the Grand Timeo Hotel, the group has introduced a Dior spa concept called ‘Le Jardin des Rêves Dior’, exposing guests to the world of Dior beauty while enhancing the Belmond experience with the brand's prestige. Tiffany, acquired by LVMH, has created a limited-edition case for Rimowa. And for a recent limited-edition Hennessy X.O., the LVMH-owned cognac producer enlisted the expertise of fellow LVMH talent Kim Jones, the current Artistic Director of Fendi's women's collections.

In each case, two parts of the portfolio have found an affinity beyond sharing their parent company – finding natural synergies in their respective brand stories, complementary expertise, and a strong appeal among a shared target audience.

LVMH is a ‘house of brands’ portfolio, meaning each brand is presented and operated entirely independently from one another, maintaining the distinct essence and equity of each. But should a brand wish to enlist new talent or embark on a brand collaboration, it’s certainly much healthier for LVMH to source that partner from within the portfolio before looking outside it.

Viewing a portfolio through a customer journey lens

Revealing these strengths in LVMH’s portfolio offers a way to examine how the portfolio can be further developed in the future – something that LVMH no doubt does itself, but also provides valuable insights for other portfolio companies in the luxury and lifestyle space.

Key questions would be:

Given typical customer journeys of affluent consumers, to what extent does the portfolio currently serve this at different points?

Is there a brand within the portfolio that could serve as the cornerstone of a customer journey – such as a hospitality brand – affording other brands within the portfolio integration opportunities?

What gaps exist within the customer journeys across the portfolio, and which brands could be future acquisition targets to fill those voids with new, inspiring experiences?

Answering these questions unlocks opportunities within an existing portfolio while helping to assess potential acquisition targets in the future.